In September 2024, the European Commission published a report titled The future of European competitiveness, better known as “the Draghi report” after the name of its lead author, former European Central Bank governor Mario Draghi. While Brussels politics is as subject to hype cycles as politics anywhere else, this particular report packs an unusual amount of firepower. The mission letters received by all incoming European Commissioners from Commission president Ursula von der Leyen tell them in no uncertain terms to draw on it. The president herself is clearly already doing that, to the point of tweaking Teresa Ribera’s job title into “Executive Vice President-designate for a clean, just and competitive transition” (emphasis mine). This appears to be the latest rebranding of the “twin transitions” (green and digital) of the 2019 von der Leyen Commission.

The 2024 von der Leyen Commission aspires to deliver economic reform, and prepares to invoke the Draghi report as the rationale for its reform agenda. This comes at an interesting time for economic policy, because in recent years – after decades of incremental tinkering around the neoclassical model – economists have come up with several new, bold theories, models, and policy implications thereof. This body of work is new enough that people are still discussing what it should be called: in what follows I call it New Economic Thinking (NET), mirroring this 2022 report by Demos Helsinki.

NET is not a single new paradigm; rather, it is a collection of approaches (Demos calls it “a landscape”). They differ, but share the conviction that neoclassical economics is unfit for purpose, and that, once you let go of the old orthodoxy, new instruments for economic policies become available. Methodologically, many of the authors associated with NET are skeptical about measuring human wellbeing in monetary terms, and prefer to fall back on physical quantities like calories intakes or square meters of housing (more on this). In fact, many of them have intellectual roots in disciplines other than economics, such as physics ( Julia Steinberger, Ole Peters) or anthropology (Jason Hickel). NET approaches have names like degrowth; post-growth; modern monetary theory; doughnut economics; wellbeing economics; and more. Both NET scholars and the group behind the Draghi report call for reform. In this article, I want to look at the report through the prism of NET, and reflect on the similarities and differences between the two.

1. Report narrative

The Draghi report starts with three statements.

- The European Union needs economic growth to realize its ambitions on social cohesion, decarbonization and strategic autonomy.

- Its economy suffers from a large and growing competitiveness gap with respect to the rival economies of the USA and China. This gap must be closed to achieve the EU’s strategic objectives.

- To increase competitiveness, Europe must invest massively, way more than at any point in its history, and pursue coherent policies across multiple areas. This is true for economics policies writ large, and beyond: trade, competition, industrial, monetary, defence development cooperation. All these policies must be tightly integrated and put in service of the overarching strategic goal of being competitive.

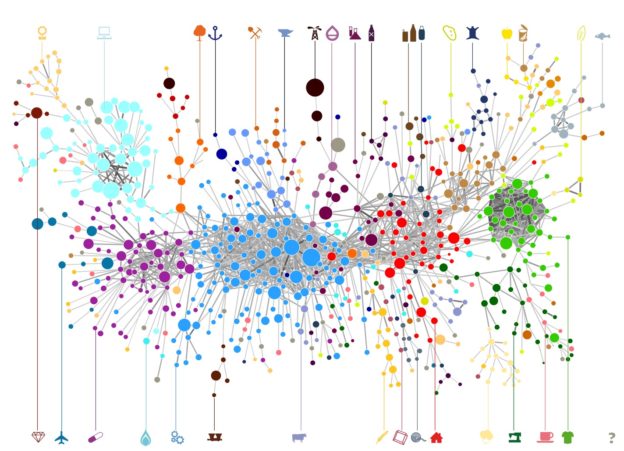

Given these premises, the report identifies intervention areas: ten sectoral policies (energy, critical raw materials, digitalisation and advanced technologies – in turn broken down into high speed and broadband networks, computing and AI and semiconductors – clean tech, automotive, defence, space, pharma and transport) and five horizontal ones (accelerating innovation, closing the skills gap, revamping competition and strengthening governance). The bulk of the report then proposes, for each of these policies, some concrete objectives and the interventions to achieve them.

Similarly, many NET scholars refute the idea of a positive linkage between economic growth and social cohesion. We have known for a long time that reported satisfaction is uncorrelated to GDP per capita: this is called the happiness-income paradox and was discovered by James Easterlin in 1974. More recently, Ole Peters has shown that systems that grow on average while practically all its participants are reduced into poverty are perfectly possible : indeed, such systems arise naturally when the income of individuals grows randomly and multiplicatively over time, like most financial markets most of the time.

As for social cohesion, it has now become clear that, from a NET standpoint, there is no automatic path from economic growth to poverty reduction. This is a key concern for academic thinkers like Jason Hickel (who argues rich countries are better off with degrowth instead), Giorgos Kallis, Tim Jackson and others. Judging from the recent report of the United Nations Special Rapporteur on Extreme Poverty and Human Rights – bearing the NET-friendly title Eradicating poverty beyond growth – these ideas are getting buy-in in the global policy space.

Social cohesion is also linked to decarbonization. The debate on just transitions shows that decarbonization is much harder for the financially more vulnerable, and therefore harder to do in more unequal societies. Joel Millward-Hopkins calculated that highly unequal systems require far more energy to provide everyone with decent living standards. The implication is that inequality is a drain on productivity when you measure input in physical terms and output in human well-being.

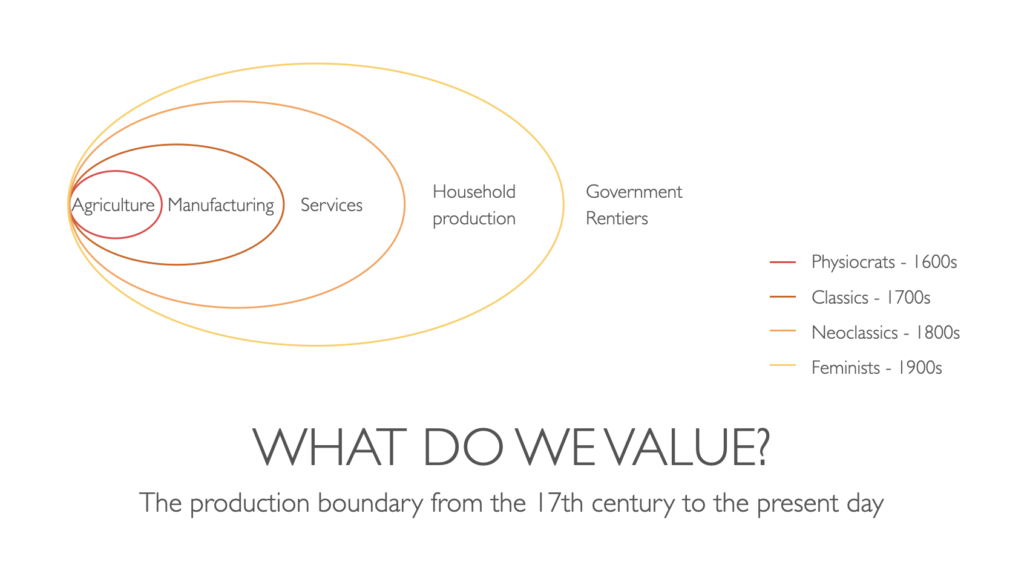

The second statement – that the European economy is less competitive than the economies of the US and China, and that this is a bad thing – looks a priori reasonable. Seen through a NET prism, however, it raises empirical and normative questions. How do we measure competitiveness? By dividing the input into the economy by it output. How does the Draghi report measure output? I have not found a methodology section in the published report, but Figure 1 uses GDP to compute productivity. That’s a fatally flawed measure of productivity, because it misses what economies are actually supposed to be producing. That would be human well-being, and GDP is simply not fit to measure it, not even approximately. This has been known since Simon Kuznets operationalized it in 1934, so I will not embark on a critique here. Suffice it to say that, when you log primary forest, you increase GDP. When you sell a public park to a real estate developer to build luxury housing on, you increase GDP. It is a wildly inadequate measure of economic performance. It is disappointing to see it used in a document of the importance of the Draghi report. NET scholars would have tried to estimate physical productivity: for example, by comparing worked hours and material input with some measure of human welfare like the United Nations’ Human Development Index.

The Draghi report’s reliance on GDP as a proxy of welfare means that its authors accept the neoclassical theory of value based on utility theory, and believe that the fundamental theorems of welfare economics apply to the European economy, at least approximately. NET thinkers reject these beliefs, as do most people who are not professional economists. This leads the report to pursuing an economy that, at times, can feel dystopian – like when the report laments that most pension systems in Europe are public and mutualized, instead of private and finance-based like in the US. This is a bad thing, if you are an investment banker, because it leaves much less hot money sloshing around on financial markets for you to profit from. But if you are a human believing in human solidarity, unwilling to trust financial markets with providing for you in your old age, you are likely to find it rather good.

From the point of view of non-investment bankers, the Draghi report suffers from a “garbage in, garbage out” problem: the best analysis will still be useless, or worse, if it aims at optimizing the wrong indicator.

3. Policy innovation – but to do what?

The third statement – that the European Union is not investing nearly enough in its future, and suffers and a gap in policy coherence with respect to the USA and China – seems intuitively correct. Europe is polycentric in nature, so everything is a hard-achieved compromise, including investment. “Frugal” member states are notoriously suspicious of public investment, seen as a machine to produce Southern European public debt and shift it to Northern Europeans. Even when there are no ideological disagreements, polycentricity means that a certain amount of horse trading is baked into any major policy decision in Brussels. On average, this reduces policy coherence: it is hard, for example, to imagine a European version of the American Inflation Reduction Act.

I can imagine several NET authors agreeing with Draghi here. Already in the foreword, the report calls for unprecedented levels of investment.

To digitalise and decarbonise the economy and increase our defence capacity, the investment share in Europe will have to rise by around 5 percentage points of GDP to levels last seen in the 1960s and 70s. This is unprecedented: for comparison, the additional investments provided by the Marshall Plan between 1948-51 amounted to around 1-2% of GDP annually.

This can-do attitude resonates with the insistence of NET scholars that we can and should do things differently, if “differently” brings better results. Scholars like Stephanie Kelton, Mariana Mazzucato, Thomas Piketty, Kate Raworth, Randall Wray have produced substantial economic policy innovations, and are advocating, sometimes successfully, for their implementation. These and other NET thinkers believe Margaret Thatcher’s quip, “there is no alternative”, to be wrong. Apparently, so does Draghi. How to organize the economy is a political choice, not an inevitability. Policy makers are more free than the study of neoclassical economics has led us to believe.

Mario Draghi began his career as an academic economist. But he is best known as a banker and a policy maker; a practitioner, more than a theorist. So, it is no surprise that the most interesting content of the report that bears his name is its discussion of various specific policies. There is some solid advice here, built on insightful analysis. For example, Chapter 3 (“A joint decarbonisation and competitiveness plan”) starts with a discussion on the root cause of energy prices. The report argues that the price of energy – gas in particular – is made “unnecessarily high” by institutional factors. Even long-term contracts are indexed to spot energy prices, and spot energy markets are vulnerable to speculation because (1) the supply is highly concentrated, and (2) the European regulation on commodities derivatives grants exemptions to companies whose primary purpose is not trading. Energy prices can be reduced and stabilized by de-financializing the energy markets; abolishing exemptions from regulation on commodities derivatives trading is a good place to start, and indeed is part of the American playbook. In a similar vein, the report offers good advice in Chapter 6, dedicated to governance: consolidate coordination mechanism; consolidate budgetary resources; extend decision making by qualified majority voting in the European Council, and so on. These are not new ideas, but the Commission may hope that Draghi’s prestige lends them extra weight.

But not all the report’s policy advice is unambiguously good. Viewed through the lens of NET, some policy proposals suffer from the fundamental misalignment, noted above, on what a “good” economy looks like. If you – like me – are sympathetic to NET approaches, it sometimes makes for disturbing reading. Several times I found things that I believe are (good) features of the European economy described as bugs. For example, regulating the tech sector (the use of the precautionary principle, data protection laws, compliance on AI) may be “a barrier to scaling up” (Chapter 2), but it has protected European citizens, at least a little bit, from the worst data protection and privacy abuse of the tech giants. Same story in Chapter 5, where the report deplores the weakness of private equity funds on the European markets. This certainly raised my eyebrows: private equity is known for asset stripping companies and impoverishing workers to the benefit of the wealthy (“buy, strip and flip”). Cory Doctorow describes its effects in a colourful, but factually correct, way:

When PE buys up all the treatment centers for kids with behavioral problems, they hack away at staffing and oversight, turning them into nightmares where kids are routinely abused, raped and murdered (NBC News). When PE buys up nursing homes, the same thing happens, with elderly residents left to sit in their own excrement and then die (Politico).

Here is a Guardian article with many links to the documented effects on private equity on the economy. It is safe to say they are not productive at all. They only appear so if you insist measuring economic output wrong. Adopting a NET perspective would have avoided the dystopian moments in the report.

4. A deeper European integration

The report builds on technical arguments to advocate for deeper European integration. We need to increase productivity; to increase productivity, we need bold, tightly coordinated policies across the board; to have those, we need deeper integration. European institutions must work in a more coherent way with one another; member states must work in a more coherent way with the EU (in Chapter 1). Specifically:

- If tighter integration means a two-tier EU (a tightly integrated core, plus a more loosely integrate outer layer), so be it.

- The EU should move towards “the issuance of a common safe asset” (in Chapter 5), by which Draghi means “emitting European sovereign debt”.

Deep integration of economic policy and sovereign debt issuance would bring the European Union closer to something like a federal state. This is a large step, but it appears much more realistic after the COVID crisis, when European institutions were deployed to protect the population from another massive financial crisis on top of the epidemic. Debt was issued, overcoming the resistance of the “frugal” member states, and the worst was avoided. Achieving social cohesion while decarbonizing the economy, Draghi argues, is also a crisis, in the sense that it cannot wait. He is not wrong in that. Why not, then, use the same instruments that have served us well before?

I expect that most of the public debate on the Draghi report will focus on these two proposals. Considerations more pertinent to NET, such as those on value theory and indicators of economic performance, are likely to be the province of economics geeks like myself. Still, GDP as a reliable measure of well-being? In 2024? it seems like a missed opportunity. Draghi could have made his two main proposals for European integration equally well from a NET standpoint. That would likely elicit more public support: most Europeans are facing insecurity and are more likely to support policy mixes that zero in on their well-being rather than on self-referential constructs like “the economy”.

UPDATE: Hans Stegeman has published a post in a similar vein. What I liked most about it is that he spent some time quantifying where the difference in GDP growth between Europe and the USA ended up making an impact: population increase, increase in the per capita income of the top 10% earners, increase in the per capita income of the bottom 90% earners. The results are surprising: the bottom 90% earners have, on average, seen their income grow more in Europe than in the USA. If you take the bottom 50%, the effect is even stronger: their average income has grown 20% more in Europe than in the USA over the period 1990-2023. This reinforces the point, made in my own post, that the Draghi report is optimizing for the wrong variables.

Photo: The Eurotower in Frankfurt am Main by Marco Verch under Creative Commons 2.0